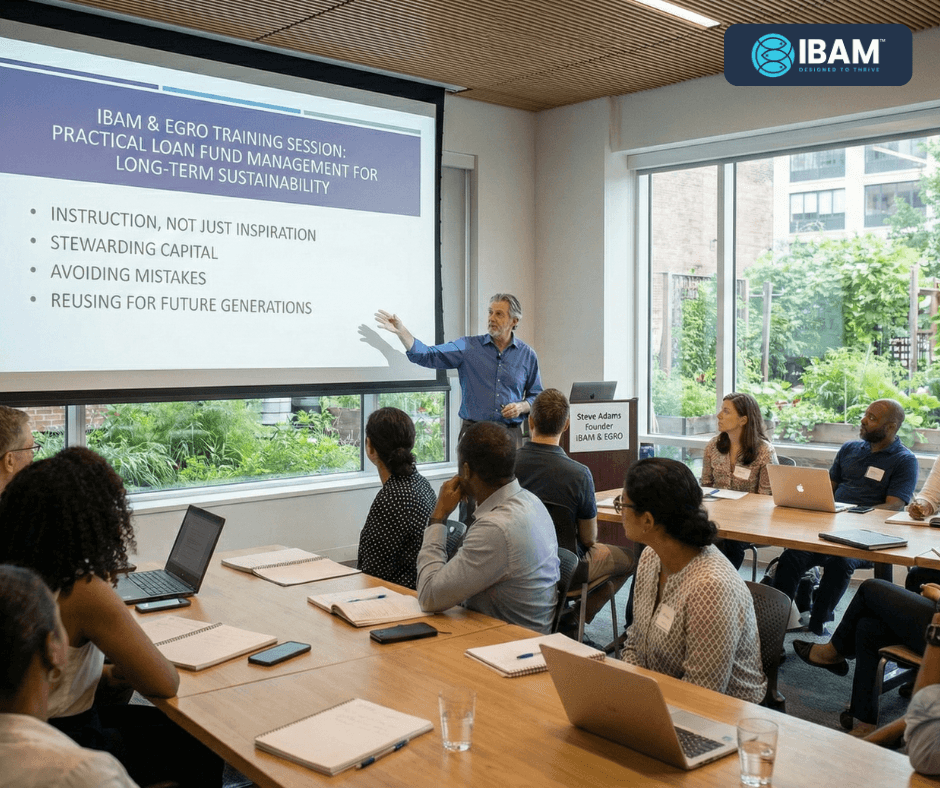

IBAM EP81: The 7 IBAM Loan Fund Principles That Protect Kingdom Capital for the Long Term, Series 1

“If I’m working with someone with poor character, I’m going to lose money every time.”

— Steve Adams | IBAM

Why small loans, strong character, and patient growth are essential for sustainable Business as Mission

This article is based entirely on a training session led by Steve Adams, Founder of IBAM and EGRO, created specifically for IBAM partners managing local loan funds. The purpose of this teaching is not inspiration alone—it is practical instruction designed to help partners manage loan funds more effectively, more efficiently, and with long-term sustainability in mind.

Steve shares lessons drawn from his early career as a corporate banker and loan officer in the United States, combined with more than two decades of experience working in international microcredit and Business as Mission. His goal is clear: help partners avoid repeating costly mistakes and instead steward capital in a way that allows it to be reused again and again for future generations of entrepreneurs.

This is not a fast-growth model. It is a quality-driven, long-term approach rooted in discipline, process, and stewardship.

Why IBAM Exists and How the Partnership Model Works

IBAM was founded with the goal of coming alongside local partners to help accelerate their vision to reach people for Christ—through business.

The original idea was simple but intentional:

Help individual believers and families start or expand businesses

Teach them how to do business God’s way

Equip them with a Kingdom vision that serves more than personal gain

Over time, this approach evolved into a clear partnership model:

IBAM raises donor funds globally

Those funds are granted (not loaned) into local partner organizations

Each partner manages a separate local loan fund

Loans are made locally, repaid locally, and recycled locally

This structure increases accountability and repayment because borrowers perceive the funds as coming from their own community rather than from abroad.

IBAM’s long-term role is not control—it is consultation, training, and support, helping partners steward funds well so they can continue empowering new generations of entrepreneurs.

The Core Problem IBAM Is Solving

One of the key challenges Steve identifies is over-dependence on donations.

Donations are not bad, and they are not going away. But when ministries rely exclusively on donations, the work often suffers when funding declines. IBAM’s model is designed to work alongside donations, providing a stabilizing economic platform that strengthens families, churches, and disciple-making movements.

Business ownership also provides believers—especially in challenging cultural or religious environments—with a way to engage their communities, regain dignity, and regain opportunity when traditional employment is lost.

How IBAM Loan Funds Are Structured

The loan fund structure follows a consistent pattern:

Donor funds raised through IBAM are granted to local partners

Funds are placed into a dedicated loan fund account

Loans are approved locally and disbursed locally

As loans are repaid, funds are recycled to new entrepreneurs

Borrowers are reminded that repayment is not just obligation—it is paying it forward so others can step into their God-given calling as well.

The 7 Principles That Guide IBAM Loan Funds

Principle #1: Make Many Small Loans, Not a Few Large Ones

IBAM intentionally limits loan size, often at a maximum of $1,000 USD.

Why?

Spreading $10,000 across 10–15 entrepreneurs reduces risk

Losing one small loan is survivable; losing a large one is not

Small loans allow more people to participate

IBAM also emphasizes that businesses can be started with limited capital, particularly outside the U.S., where costs are generally lower.

Principle #2: Only Loan to Service-Based Businesses

IBAM does not loan money to product-based businesses such as:

Stores

Cafés

Restaurants

Manufacturing startups

These businesses have a high failure rate.

Instead, IBAM focuses exclusively on service businesses, such as:

Repair services

Cleaning services

Skilled trades

Professional services

Service businesses:

Require minimal capital

Depend more on personal character and effort

Put entrepreneurs directly in front of people

Consistently demonstrate higher repayment rates

Principle #3: Only Loan to People of Demonstrated Godly Character

Legal contracts cannot compensate for poor character.

Steve explains that no matter how strong agreements are, lending to someone without integrity almost always results in loss. IBAM therefore requires that borrowers:

Are known personally by leadership

Have demonstrated faithfulness over time

Show evidence of life change after coming to faith

Past failure does not disqualify someone—but time and trajectory matter.

Principle #4: Shorter Repayment Periods Reduce Risk

IBAM strongly prefers loans with repayment periods of one to two years, never exceeding three.

Loan fees (not interest) are structured by duration:

1 year: 10% fee

2 years: 20% fee

3 years: 30% fee

Longer loans increase risk and were consistently linked to failures in the past—especially with product-based businesses.

Principle #5: Monthly Financial Reporting Is Required

IBAM’s model works best in urban or semi-urban environments where:

Entrepreneurs can maintain records

Monthly reports can be submitted

Financial data is logged consistently

Monthly reporting creates accountability and allows entrepreneurs to make small adjustments before problems become crises.

If reporting cannot happen, the model should not be used.

Principle #6: Be Proactive When Problems Arise

When borrowers struggle, they often hide. IBAM encourages the opposite approach:

Early conversations

Honest dialogue

Supportive intervention

Most business problems are common and solvable. Early coaching shortens the learning curve and protects the loan fund.

Principle #7: Concentrate Before Expanding

IBAM advises partners to:

Focus on one geographic area first

Build experience and success stories

Develop strong loan committees and trainers

Expand only after proven results

Rapid growth creates fragility. Sustainable growth requires patience.

Why Speed Is the Enemy of Sustainability

Steve emphasizes that loan funds are not a “speed ministry.”

Training can happen quickly

Lending cannot

If loan funds fail too often, donor trust erodes and future funding becomes impossible. Integrity with donors requires disciplined stewardship and high repayment rates.

This is a long-game strategy, compared to planting trees that may not bear fruit for decades.

Final Encouragement to Partners

IBAM’s process was refined over 20 years and is designed to work when followed faithfully. Success depends on:

Following the system

Training trainers thoroughly

Maintaining accountability

Thinking generationally

This approach is not flashy—but it is sustainable.

👉 Watch the full episode here: https://youtu.be/VziCSeUMrGg

👉 Join the mission: https://www.ibam.org

This blog post is written exclusively from the EP 81 transcript featuring Steve Adams. All principles, explanations, examples, and language are derived directly from the spoken content without added interpretation or external sources.

Become an Impact Partner...

Share and Comment...

Download Your FREE Resources Below